Many of you may remember back in 2008 - as our economy was heading into full meltdown - there was also a food crisis hitting the entire globe. The price of wheat skyrocketed - creating panic around the world. 2008 became the first year in human history that the population of those who went hungry increased - an increase of more than 250 million people - in a single year! More than a billion people bordered on starvation. The food crisis was even felt in America where 49 million people struggled to feed themselves and demand for food stamps and soup kitchens increased considerably.

It was chaos.

But there was something strange about the 2008 food crisis and the price of wheat that caused it. Simply - there was no shortage of wheat. In fact - 2008 yielded the largest amount of wheat in the history of the world! 657 million bushels weren't sold at all! There was a record breaking surplus! So - with such an enormous supply of wheat - what caused prices to shoot up?

The answer is on Wall St.

In 1991 - Goldman Sachs was looking for another financial instrument to sell. They were tired of speculating with debt and real estate and realized the new horizon was food. So they created an index of commodities like cattle - corn - and wheat - that they could then sell to investors. As more and more investors bought into the food index - prices began to rise. So despite there being plenty of wheat - prices continued to climb thanks to investors purchasing more and more future food commodities. And in 2008 - "The Economist" noted that food prices had increased to a level not seen since 1845.

A bubble was being created - thanks to Goldman Sachs.

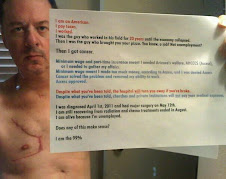

But - as then Chairman of the Kansas City Board of Trade pointed out, "This isn't just any commodity - It is food - and people need to eat." He was right - Wall Street bankers had manipulated the price of the most basic need for everyone on the planet - food - and the effects of the gamble rippled across the entire globe with hundreds of thousand of people dying of starvation. Meanwhile Goldman made a killing in profits - literally. Eventually - the bubble burst and prices returned to normal - but the damage was already done. The food crisis of 2008 was merely a by-product of loose oversight in our markets and millionaires and billionaires who had more money than they knew what to do with - thanks to the Reagan and Bush tax cuts.

This should be a lesson learned, right?

In today's "Financial Times" there was a story about food prices in the US spiking again. Due to extreme weather the US Agriculture Department once again cut crop forecasts and warned of a shortage in grain production. Corn yield estimates have now been cut for a third month in a row causing the price to jump to $6 a bushel for the first time since back in 2008. Cotton and soybeans also posted high prices reminiscent of the 2008 global food crisis. As food prices are on the rise - will Wall St. jump in the game again? After all - what else are they going to do with their billions?

Rinse, wash, repeat.

-Thom Hartmann

(How are you preparing for the food bubble? Tell us here

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment